November 22, 2023

Navigating the Future: Key Features of Tech-Focused D&O Insurance Software

In the rapidly evolving landscape of the technology sector, Directors and Officers (D&O) insurance plays a crucial role in safeguarding the decision-makers behind innovative companies. As technology advances, so does the need for specialized software to manage the complexities of D&O insurance in this sector. This article explores the essential features and capabilities that tech-focused D&O insurance software should possess, ensuring seamless policy management, claims tracking, and compliance monitoring.

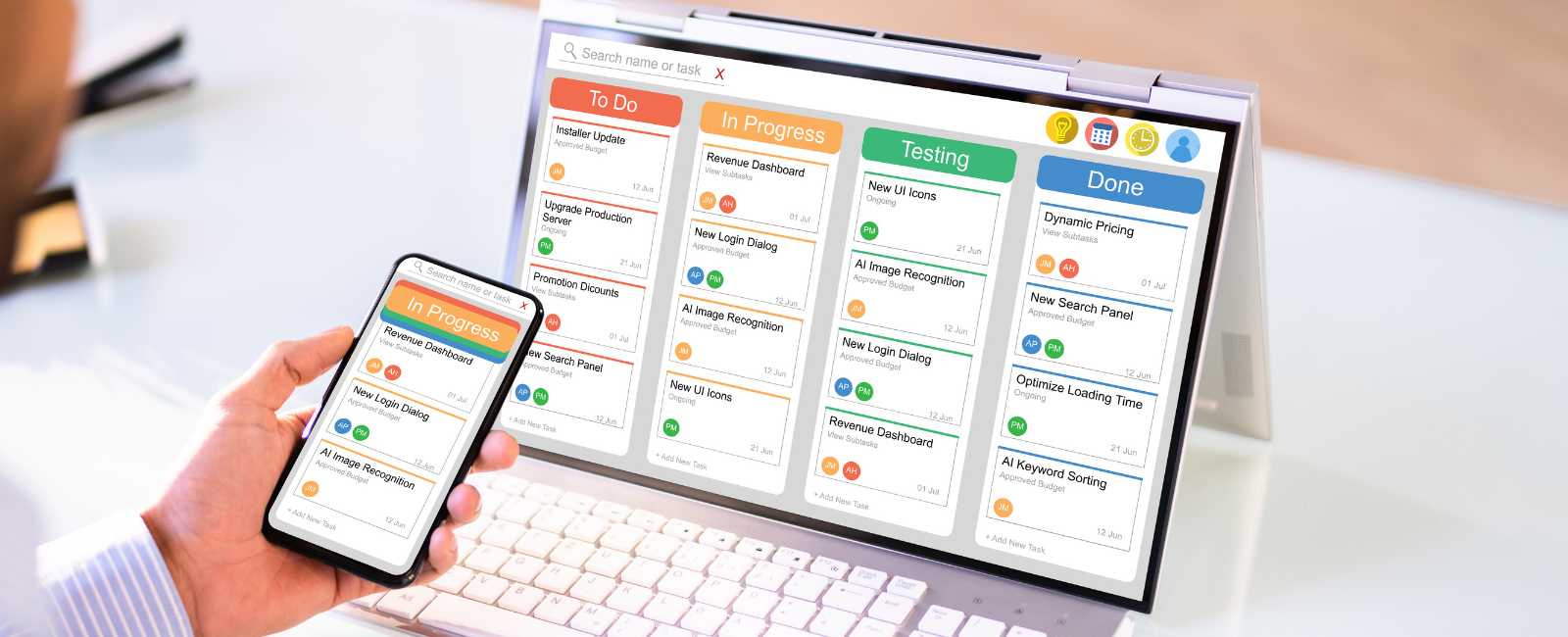

- Intuitive Policy Management: Effective D&O insurance software for the tech industry must provide a user-friendly interface for policy management. This includes features such as policy creation, modification, and renewal. The software should allow for easy customization of policies to accommodate the unique risks and challenges faced by technology companies. This ensures that policies can be adapted to keep pace with the ever-changing landscape of the tech sector.

- Claims Tracking and Analysis: A robust claims tracking system is a fundamental requirement for D&O insurance software. In the tech industry, where litigation risks are prevalent, the ability to monitor and manage claims efficiently is critical. The software should facilitate real-time tracking of claims, providing detailed analytics and reports to help organizations understand the nature of claims, their frequency, and the financial impact on the company. This feature enables proactive risk management and strategic decision-making.

- Comprehensive Compliance Monitoring: Compliance is a cornerstone of D&O insurance, and for the tech sector, which operates in a highly regulated environment, monitoring and ensuring compliance is paramount. Tech-focused D&O insurance software should offer robust compliance monitoring features, including regulatory updates, alerts, and audit trails. The software should be capable of adapting to changes in regulations and automatically updating policies to maintain compliance, reducing the risk of legal consequences due to non-compliance.

- Data Security and Privacy Compliance: Given the increasing concerns around data security and privacy, tech-focused D&O insurance software must prioritize these aspects. The software should comply with industry standards and regulations related to data protection. This includes features such as encryption, access controls, and regular security audits. Ensuring that the software itself adheres to the highest standards of cybersecurity is crucial for maintaining the trust of tech companies that handle sensitive information.

- Advanced Analytics and Reporting: To make informed decisions, tech-focused D&O insurance software should provide advanced analytics and reporting capabilities. This includes predictive analytics to assess potential risks, identify trends, and optimize insurance coverage. Comprehensive reporting tools should offer insights into the financial health of the insurance program, enabling stakeholders to make strategic decisions based on data-driven analysis.

- Integration with Other Systems: Seamless integration with other enterprise systems is a key feature for D&O insurance software in the tech sector. Integration with risk management systems, financial platforms, and legal databases ensures a holistic approach to decision-making. This interoperability streamlines processes, reduces manual data entry, and enhances overall efficiency.

Conclusion

In conclusion, the dynamic nature of the technology industry demands specialized tools to manage the complexities associated with D&O insurance. Tech-focused D&O insurance software should go beyond basic functionalities and offer a comprehensive suite of features, including intuitive policy management, claims tracking, compliance monitoring, data security, advanced analytics, and seamless integration. By investing in such software, technology companies can fortify their risk management strategies, protect their leadership teams, and navigate the intricate landscape of the tech sector with confidence.

In conclusion, the dynamic nature of the technology industry demands specialized tools to manage the complexities associated with D&O insurance. Tech-focused D&O insurance software should go beyond basic functionalities and offer a comprehensive suite of features, including intuitive policy management, claims tracking, compliance monitoring, data security, advanced analytics, and seamless integration. By investing in such software, technology companies can fortify their risk management strategies, protect their leadership teams, and navigate the intricate landscape of the tech sector with confidence.

Get Instant D&O Insurance Quote

Get a free, no obligation quote within minutes

"*" indicates required fields

to speak to an D&O insurance expert now